No Tax on Overtime — FAQ

Pursuant to H.R.1, referred to as the “One Big Beautiful Bill Act,” signed into law on July 4, 2025, includes a provision called “No Tax on Overtime,” which introduces a federal income tax deduction for certain types of overtime pay. You can visit the IRS website for additional information.

When is this effective? Accordion Closed

The effective date was January 1, 2025. This deduction is effective for calendar years 2025 through 2028.

Who qualifies? Accordion Closed

Employees who receive overtime pay under Section 7 of the Fair Labors Standards Act (FLSA). This applies to NAU employees who are hourly and entitled to 1.5 times their hourly rate for hours physically worked over 40 in a week.

Will I see reduced federal taxes on my paycheck? Accordion Closed

No, overtime wages are still subject to withholding taxes (Social Security, Medicare, etc.). The deduction applies when an employee files their tax return.

NAU is still required to withhold federal income taxes based on the employee’s W-4 elections.

What earnings qualify for the deduction? Accordion Closed

The only qualified earnings are those associated with the FLSA defined overtime.

Do the full overtime earnings (1.5 X the hourly rate) count toward the deductions? Accordion Closed

No, only the “half” portion (.5) of the overtime qualifies for the deduction and is labeled as “premium overtime.”

How is the deduction claimed? Accordion Closed

The deduction is claimed when an employee files their tax return. This is an above-the-line deduction, meaning it is available regardless of if an individual itemizes their deductions or not.

Is there a deduction limit? Accordion Closed

Yes, the maximum deduction is $12,500 for single filters and $25,000 for joint filters.

How do I determine my overtime deduction? Accordion Closed

Find the total amount of overtime pay you earned this year.

Example:

If your regular rate is $20/hour and you work 100 overtime hours.

(Regular rate of pay at $20 per hour, 1.5 x $20 = $30 OT Rate)

- Overtime pay = 100 hours × $30 = $3,000

- Regular pay portion = 100 × $20 = $2,000

- Premium portion= $3,000 – $2,000 = $1,000 (this is deductible)

Does supplemental pay qualify for the deduction? Accordion Closed

Yes, for non-exempt employees, supplemental pay is considered overtime compensation and is paid at 1.5 times your hourly rate so the .5 is considered “premium” overtime.

Do FLSA Exempt employees qualify for any overtime deductions? Accordion Closed

No FLSA Exempt employees do not qualify for overtime, so the deduction does not apply.

Will I receive a notification from NAU stating my qualified overtime deduction amount? Accordion Closed

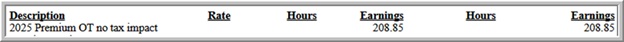

Yes, each employee with qualifying overtime will receive a notice that they have “premium” overtime. Your final paycheck of 2025, issued on 12/26/2025, contains the following information which is the amount of your “premium” overtime for 2025.

Does the deduction apply when I use my accrued comp time? Accordion Closed

Yes, per the IRS, one-third of this pay is considered “premium” overtime, additionally, when employees are paid out for accrued comp time one-third of this pay is also considered “premium” overtime.

Will this amount be included on my W-2 Accordion Closed

Yes, for 2025 your “premium” overtime is reported in box 14TT on your W-2.

Does the deduction apply when I use my accrued comp time? Accordion Closed

Yes, per the IRS, one-third of this pay is considered “premium” overtime, additionally, when employees are paid out for accrued comp time one-third of this pay is also considered “premium” overtime.