Introduction

Arizona remains a leader in total installed solar capacity, ranking second nationwide. As utility-scale solar and wind component and development costs have dropped in recent years, Arizona has experience significant growth; nevertheless, policy challenges and the lack of an aggressive state RPS have slowed development in 2014-2015.

Our 2015 research found that utility-scale solar installations across the state totaled 1486 MW, including 1199MW of solar photovoltaics (PV) and 287 MW of concentrating solar power (CSP). Despite rapidly dropping costs, however, utility-scale solar development across the state has slowed considerably, as most of the state’s utilities have met renewable energy generation requirements, and demand for electricity is not currently growing. There are thousands of megawatts of solar projects at some stage of development across many counties, but only 46 MW under construction. Wind installations remained at 238 MW installed, with an additional 30 MW under construction. While there are thousands of megawatts of wind projects that have been pursued to some degree by developers, including resource assessment or pre-development meetings with County planners or the Arizona Game and Fish Department, wind development is relatively quiet in the state in 2015.

Energy trends

The abundance of undeveloped land and available renewable resources create good conditions for both solar and wind energy development in Arizona. Within the past decade, Arizona has become a hub for solar energy development and the state continues to be a leader in solar energy generation nationwide.

Solar

Arizona’s relatively flat topography, access to transmission lines into neighboring states, and outstanding solar resource are drivers of development. Prices for both residential and commercial systems in Arizona have dropped 12 percent in the last year— ahead of the national average, which is 8 percent. In 2014, $624 million was invested in solar energy installations in Arizona, and there were over 389 solar companies working throughout the state.

Solar component prices –particularly modules – have dropped significantly over the last several years, making solar cost-competitive with other sources of new generation for the first time. As nearby states ramp up their Renewable Portfolio Standards, and the region faces the prospect of shutting down multiple coal plants and seeking additional sources of low-carbon energy, solar development in Arizona will likely continue.

Solar development in Arizona has been primarily PV, although the state is home to the Solana Generating Station, a 280-MW parabolic-trough CSP facility that boasts 6 hours of energy storage through molten salt heat exchanging technology. Concerns over water use and availability, along with plummeting PV module prices, have slowed the development of other CSP facilities, and more developers are exploring dry-cooling or hybrid technologies, or re-tooling development plans to construct PV plants in their stead.

The Solana Generating Station in Maricopa County, 290-MW Agua Caliente PV plant in Yuma County, and Arlington Valley I and II projects at 250MW also in Maricopa County, are the three largest solar installations in the state. Because of the state’s generally spectacular resource, and the ability of utilities to own or contract from smaller (5-20MW) PV systems across geographic areas, there is significant solar capacity generating or under development in the majority of Arizona’s counties.

Wind

Wind energy development in Arizona has proceeded, albeit slowly, over the past decade. Compared to wind resources found in neighboring states, Arizona’s wind generating potential is less consistent throughout the year, and is of course limited to specific geographic areas. Additionally, the repeated expiration of the Production Tax Credit has slowed wind ‘prospecting’ in the state. Other factors, such as the checkerboard land pattern across many counties and the resulting multi-jurisdictional permitting processes for wind farms, have also made it challenging for developers to build. While wind development in Arizona may be more challenging than in other nearby states, low costs and advancements in turbine technology for lower wind speed sites support the potential for Arizona to expand as a thriving market for wind developers. Both the costs of development and the sale price of wind power have dropped significantly over the past four years, benefiting utilities and consumers. Technology enhancements and the advent of increasingly taller towers and longer blades allow turbines to generate more energy in lower wind speed areas, opening more areas to development.

The Dry Lake I and II, Perrin Ranch, and Kingman I wind farms are the three operational wind farms in Arizona. Another 1 MW turbine is located on the Fort Huachuca Army Base. In addition, the 30-MW Red Horse wind farm in Cochise County is under construction. These have a total generation capacity of 268 MW. There are other projects that are approved or under development across the state. There are wind projects that obtained development permits in Mohave, Yavapai, Coconino and Navajo Counties, but two of these have let their permits lapse, and the other two do not appear to be moving forward. There are multiple projects in the hot southern Arizona counties pursuing development of wind ‘towers’ that use thermal gradients or water cooling to drive turbines in very tall structures. Neither of the proposed projects has broken ground, although both have been permitted by the respective local county jurisdictions.

Native American communities

Native American communities in Arizona continue to pursue renewable energy development at all scales. Many tribes and communities have solar installations for government buildings, residences, commercial operations, or to power remote sites without grid access, such as radio towers. The Fort Mojave Tribe worked for the past several years on a project to build 310 MW of PV capacity on tribal trust land, including completing an Environmental Impact Statement and submitting an application to the Nevada Public Utilities Commission to build a transmission line extension from the project site to the Mohave Generating Station substation, but has not been able to secure a viable development partner. The San Carlos Apache Tribe is engaged in building a 1-MW PV project to power its casino enterprise, and the Pascua Yaqui Tribe is pursuing a similarly-sized PV system for its casino operations. Several other tribes including the Navajo Nation, Hopi Tribe, Gila River Indian Community, and Hualapai Tribe are pursuing utility-scale solar or wind development.

State policies & initiatives

Renewable energy standard

Two new commissioners were elected in 2014 to the Arizona Corporation Commission (ACC), the regulatory body responsible for setting the price for gas, water, and electricity for many of the utilities in the state. There have been no changes to utility-scale renewable energy policy at the ACC level since this election.

In addition to setting rates, the ACC is responsible for setting policy to expand the use of renewable energy sources in the state. The Renewable Energy Standard and Tariff (REST), established in 2006, is the primary state mechanism for achieving these goals. The REST requires that investor-owned utility companies, and electric co-ops serving more than half of their retail customers in Arizona, generate 15 percent of their electricity from renewable sources by 2025.

To meet the standard, the utility companies must retain or obtain renewable energy credits (RECs) to represent the renewable energy attributes of eligible projects. Compliance with this requirement changes each year, steadily increasing until Arizona reaches its 15 percent goal in 2025. In 2015, Arizona is required to meet a compliance goal of 5 percent of electricity generated from renewable sources. As of the 2014 compliance reports, Arizona’s largest investor-owned utility company—Arizona Public Service (APS)—had exceeded the REST requirements.

Energy plan

In 2014, Arizona released its first comprehensive state energy plan in more than 20 years. Empower Arizona: Executive Energy Assessment and Pathways outlines the state’s energy goals for the next 10 years, highlighting Arizona’s goal of becoming a leader in residential and utility-scale solar development. Since the report’s release, a State Energy Advisory Board has been created to discuss possible updates to the plan. The 15-member board met for the first time in October 2014 to discuss new federal emissions standards and how they will affect Arizona. The board plans to meet semi-annually, with the responsibility of updating and improving the state plan at least every five years.

State electric utility companies and net-metering

With the increase in distributed generation systems on residential and commercial properties across the states, there has been growing concern among the electric utilities as to the potential costs these customers are imposing on the system at the same time as their net-metering of electricity leads to lost revenue for the utilities. In 2013, the Arizona Corporation Commission (ACC) heard a request from Arizona Public Service Company (APS), Arizona’s largest utility company, to institute new fees ($50-$100/month) or a new, reduced, net-metering compensation structure for residential solar customers, in order to recover the ostensible system maintenance costs that residential customers were not paying when they net-metered all of their kilowatt-hours. The Commission voted instead to allow a fixed monthly fee of $0.70 per kW of installed PV capacity for residential distributed solar customers. In April 2015, APS filed a new proposal with the ACC to increase this fee to $3 per kW of installed capacity per month for future solar customers. Since then original APS 2013 docket on this issue, the other leading utility companies in the state have worked to change their own net-metering policies. The Salt River Project (SRP), Arizona’s second-largest electric utility, which is not governed by the ACC, voted in early 2015 to move residential customers with rooftop solar to a new rate plan with the same structure as commercial rates, which would reorganize basic service fees into a $30-$45 monthly charge, based on the size of the consumer’s electrical service, and further institute a separate new charge for customers’ peak demand during the critical afternoon-evening operation hours, on top of per-kWh charges. Tucson Electric Power (TEP) has also approached the ACC with a proposal to change its net-metering policy, so that instead of being credited the full residential rate for each surplus kWh of electricity generated, customers would be paid at the rate TEP pays for utility-scale solar PV generation – less than half the residential rate – but would still pay full costs for kWh they use from the utility. In response, ACC Staff recommended that net-metering changes take place only within a full rate case, and not as a separate docket. At the same time, TEP and APS are both getting into the residential solar installation business on their own, with successful proposals to the ACC that they as utilities install and own distributed systems, providing homeowners with various financial incentives for their participation. Impassioned debate is raging about the ethics and economic benefits and drawbacks of these potential policy changes, and similar discussions are taking place nationwide.

Federal policies & initiatives

New federal regulations – EPA Clean Power Plan

On June 2, 2014, the Environmental Protection Agency (EPA) proposed new standards to reduce greenhouse gas emissions from existing electric generation units by 30 percent (from 2005 levels) by 2030. These new federal standards will require Arizona to cut carbon dioxide emissions from power plants by 52 percent, encouraging the state to limit its reliance on coal. Arizona anticipates reaching this goal primarily through an increase in natural gas production statewide. The Arizona Department of Environmental Quality is charged with developing the state’s implementation plan, and is working with stakeholders, naturally including all of the state’s electric utilities, to explore options for meeting the goal while maintaining system reliability and electricity affordability. The final rule from the EPA is expected in late summer 2015, and Arizona’s plan for implementation is due one year later.

Wind Production Tax Credit (PTC)

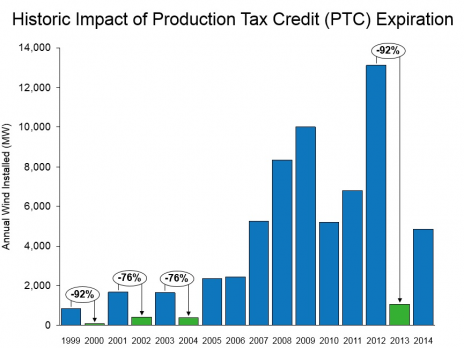

The Wind Production Tax Credit (PTC), which was set to expire in December 2013, was extended in late 2014 through the end of the year. A proposal for a five-year extension of the PTC was shut down in January 2015. The PTC provides qualifying commercial energy production facilities with a tax credit for every kWh of energy produced within its first 10 years of operation. The PTC has been a critical component for growth in the wind industry over the past several years. Due to the expiration of the PTC in 2015, significant market growth within the wind industry in the coming years remains uncertain.

Solar Investment Tax Credit (ITC)

The Solar Investment Tax Credit (ITC) provides a 30 percent tax credit for utility-scale, commercial, and residential solar systems, valued as 30% of the total cost of system installation. The ITC remains in effect through December 31, 2016, at which time it will decrease to a 10% tax credit. The ITC is responsible for significant growth within the solar industry, driving down costs for consumers and encouraging solar development nationwide.

Environmental issues

Environmental concerns continue to play a significant role, both positive and negative, in renewable energy development in Arizona. Because wind and solar (PV) projects are low in water usage, they are continually noted as alternatives to more water-intensive energy production methods, such as coal and natural gas. This is especially important in Arizona, which continues to face a drought of nearly 15 years. As concerns about water availability drive speculation about reduced capacity at the state’s hydroelectric facilities, considerations regarding water use in future generation capacity become all the more critical. In addition, because wind and solar technologies emit no greenhouse gases, the EPA Clean Power Plan could drive significant additional development of these technologies in the state.

While concerns remain about the potential for wind and solar development to cause harm to local wildlife and habitats, developers and government agencies are taking action to mitigate environmental damage. In 2009, the Arizona Game and Fish Department (AGFD) published wind energy development guidelines for reducing impact to wildlife. The report, Guidelines for Reducing Impacts to Wildlife from Wind Energy Development in Arizona, highlights the importance of pre-construction studies and site surveying. The report includes recommended methods to best reduce avoid habitat fragmentation and minimize avian collision hazards. In 2010, AGFD released similar guidelines for solar energy development and wildlife protection in the state.

The Bureau of Land Management (BLM) has also taken measures to avoid environmental impacts by establishing solar energy zones (SEZ) through their Western Solar Plan. These zones, which have been assessed for environmental impact and economic feasibility by the BLM, were created to guide developers to build in areas most suitable for solar energy. Approximately 3 million BLM-managed lands in Arizona were identified as potentially suitable sites for solar development. BLM Arizona’s Restoration Design Energy Project (RDEP) categorized an additional 192,000 acres as minimal-impact priority sites for solar or wind development.